CALL US NOW (Mon-Fri, 8am – 5pm PST) ![]() for a FREE QUOTE or fill out this form:

for a FREE QUOTE or fill out this form:

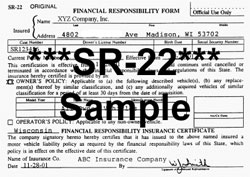

SR22 insurance isn’t legal insurance however a certification which is filed together with the DMV to state that you’re in conformity with the required car insurance plan laws of your state. This certification filed reveals the state you have evidence of financial obligation, which is a necessity of maintaining your driving license within an active status. A SR 22 insurance submitting is compulsory when somebody has been uncovered driving without car insurance or minus the appropriate quantity of automobile insurance coverage required legally.

Sr-22 insurance is normally needed in the majority of States after an alcohol-related driving conviction like DUI ( drunk driving). Even though in plenty of States it’s three years, the period of time you are expected to hold sr-22 insurance will vary from State to State.

Every state has different prerequisites and guidelines for taking the SR 22. Subsequently move to still another, in case you’d it one-state, you’ll need to apply for a fresh SR-22 n that new state. You’ll need to know more about the more recent demands of the liability insurance policy too. Plus, by increasing their insurance rates underwriters naturally reinforce great driving behaviour with credits and penalize lousy motorists.

SR22 Insurance Cost

The SR22 insurance cost for you personally will be dependent on distinct variables. You’d need to assess with them if it could be integrated together with the sr-22 insurance, in case you’d some insurance contract before. The SR22 insurance price will be more than your prior insurance prices. But if they can’t be integrated jointly, you would have to get a different insurance coverage to insure your SR22 status also.

Just how Much Does SR-22 Insurance Cost?

After inquiring “How much does SR 22 insurance cost”, the next largest concern is how you can go about getting it. Although submitting demand may fluctuate based on which state you reside in, the basic prerequisites for getting sr-22 insurance stay the exact same. You’ll need to procure an automobile insurance type from an insurance agency which is authorized to compose fiscal obligation insurance policies. The underwriter will have to send the SR 22 documentation right to the Division of State, after the strategy is set up.

Suggestions on how to go for a sr-22 insurance with the best price

Selecting a sr-22 insurance is a procedure which you need to go through really meticulously as it may lead one to pay more when you may have compensated less in several other choices. Distinct insurance companies supply you with another SR22 insurance price for your individual instance. They are going to make this selection in line with your previous record of other driving violations, the amount of tickets you’ve had and the state guidelines. Once you get an estimate for the SR 22 insurance price, you’ll be able to compare it together with estimates of other insurers. By examining all of the data and numbers, you’d be in a position to opt for an insurance provider that provides you the most effective estimate.

How to Get Non Owners SR22 Insurance

Motorists who don’t possess a vehicle but nonetheless desire to re-instate their driving privileges might have to supply non-owner low-cost SR22 coverage.

A non owner SR22 insurance plan will insure you against financial obligation claims plus it’ll keep the state updated by means of your auto insurance money. This particular kind of coverage is a good pick for an individual without routine use of a vehicle. It will provide you with a great opportunity to get your permit status back to great with nominal price. In the smallest amount, you’ll need to buy obligation limitations at your state’s minimal limitation condition . A Non owner SR-22 Insurance policy is fundamentally a Non Possessor’s car insurance with an SR22 submitting supported.

Sr22 Filing

The filing demands for an SR22 bond can fluctuate a whole lot from state to state. Usually, nevertheless, so that you can get SR22 coverage, somebody should first get vehicle insurance policy from an insurance agency which is authorized by their state to compose fiscal obligation insurance policies. The plan must offer a quantity of protection which is at least satisfactory enough to fit the state’s minimal liability coverage conditions.

Once you recover driving privileges, it is crucial that you maintain a clear driving report. At that stage, your permit might be frozen again or the state might take other significant activities which will restrict your power to operate a vehicle.

CALL US NOW (Mon-Fri, 8am – 5pm PST) ![]() for a FREE QUOTE or fill out this form:

for a FREE QUOTE or fill out this form: